MENUMENU

Last Updated on December 14, 2023 by richard -->

Traveling is an exhilarating experience, but unforeseen events can quickly turn a dream vacation into a nightmare. That's where travel insurance comes into play. One of the leading platforms in this domain is InsureMyTrip. But how does it fare against its competitors? Let's dive deep into an unbiased review.

Pioneering Insurance Comparison: InsureMyTrip stands out as one of the first significant travel insurance comparison sites, boasting over two decades of experience. It operates as a broker, allowing travelers to compare policies from various insurance companies, ensuring they receive the best coverage tailored to their specific needs.

User-Centric Features and Guarantees: The platform is lauded for its user-friendly design, making it easy for travelers to navigate and compare policies. InsureMyTrip offers several guarantees, including the Best Plans, Price, and Money Back Guarantees, instilling confidence in users. The platform's commitment to transparency and quality is further highlighted by its collaboration with 21 renowned insurance companies.

Evolution and Dedication: Since its inception in 2000, InsureMyTrip has continuously evolved to cater to the dynamic needs of travelers. The platform's growth, design enhancements, introduction of guarantees, and the addition of educational resources underscore its unwavering commitment to its customers, making it a top choice for travel insurance resources.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

Founded in 2000, InsureMyTrip emerged as the first significant travel insurance comparison website. With over two decades in the industry, it has catered to over 4 million customers, connecting them with top-rated insurers. InsureMyTrip’s straightforward quoting system aids in selecting optimal coverage by comparing leading plans from reliable providers. For assistance, their licensed insurance agents are available to help you at every stage of your trip.

Unlike traditional insurance providers, InsureMyTrip operates as a broker. It doesn't offer policies or underwrite claims. Instead, it provides a platform for travelers to compare policies from various insurance companies, ensuring they get the best coverage tailored to their needs. The company offers a seamless travel insurance shopping experience. In under a minute, users have the ability to compare side-by-side travel insurance quotes from America’s top, and most trusted providers. Here is the sequence of questions on Insuremytrip.com.

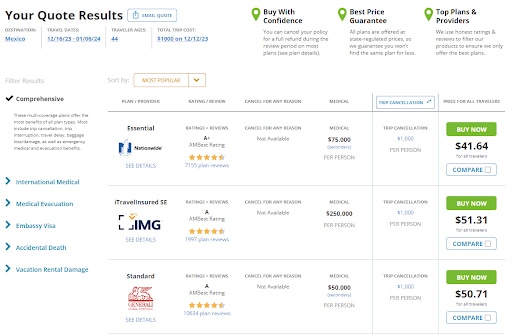

Once the above information is complete a beautifully laid out quote comparison page is presented as seen below.

*The quotes shown above are for display purposes only and do not necessarily reflect the pricing an individual may receive.

It is important to note that on the quote display page, InsureMyTrip provides far more options than the three in the example. Typically, you will be presented with 20 or more options. The quote page has a particularly smart set up as you are able to gather more information on each individual company; thus simplifying the purchasing decision. This is done via pop-up data on the screen. Users can see additional company details, reviews and coverage options, without ever leaving InsureMyTrips website.

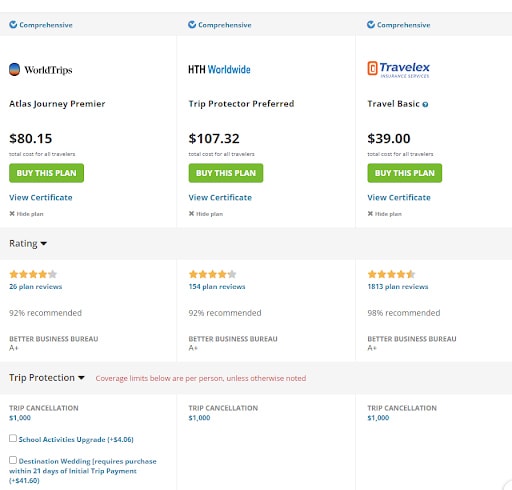

What’s even better is that the actual comparison has not even begun yet. This happens when the user clicks however many “compare” boxes they like. From there, side-by-side options are shown as in the example below:

*The quotes shown above are for display purposes only and do not necessarily reflect the pricing an individual may receive.

From here, completing the purchase is simple. All confirmations, purchase receipts and travel insurance documentation will be mailed or emailed to you - it’s that easy.

In this section, we look into the core attributes that set InsureMyTrip apart in the realm of travel insurance. From an expansive selection of policies to strategic collaborations with renowned insurers, discover how the platform's user-friendly interface simplifies the decision-making process. Also, the real experiences of users shared on Trustpilot, sheds light on the platform's reliability and its pivotal role during unexpected travel disruptions, such as the challenges posed by the COVID-19 pandemic. As we explore these key features, gain insights into how InsureMyTrip stands as a trusted companion for travelers seeking comprehensive coverage and a seamless insurance experience.

InsureMyTrip provides a diverse array of policies covering medical, evacuation, Schengen visa, and accidental death insurance, ensuring travelers find the coverage that suits their specific needs.

Partnering with 21 top-rated insurance companies, InsureMyTrip guarantees quality and reliability in its offerings, giving users peace of mind during their travels.

Praised for its simplicity, the platform's design facilitates easy navigation and quote retrieval, making the insurance comparison and purchase process effortless for users of all technical backgrounds.

InsureMyTrip enjoys positive reviews on Trustpilot, with customers highlighting its exceptional customer service during challenging times, such as COVID-19 cancellations. The platform's reliability and user-friendly experience make it a go-to choice for travelers.

InsureMyTrip offers several guarantees to boost user confidence:

Best Plans Guarantee: Only plans with positive ratings are showcased, ensuring that users are presented with top-rated insurance options.

Price Guarantee: InsureMyTrip promises that users won't find a lower price for the same plan elsewhere. This ensures that customers are getting the best possible price for their chosen plan.

Money Back Guarantee: If users are not satisfied with their chosen plan, they can cancel it during the review period (usually within 10 days of purchase) and get a full refund, provided no claims have been made and the insured trip hasn't started.

Embarking on the journey of selecting the right travel insurance is a crucial decision for any traveler. In this section, we carefully examine the advantages and drawbacks of InsureMyTrip, providing you with a nuanced perspective to guide your choices effectively. From its stellar reputation and comprehensive coverage options to potential considerations, we explore both sides of the coin to empower you in making an informed decision for your travel insurance needs.

Here are a few of the advantages of working with InsureMyTrip:

Vast Range of Providers: Connects users to a plethora of popular travel insurance providers, ensuring a wide variety of options.

User-Centric Approach: Prioritizes providers based on customer reviews, ensuring that the best-rated plans are showcased.

Comprehensive Comparison: The platform's comparison tool allows users to filter and sort policies based on their specific needs, such as trip duration, destination, and type of coverage.

Educational Resources: InsureMyTrip offers a range of articles and guides to help travelers understand the nuances of travel insurance.

Guarantees: With the Best Plans, Price, and Money Back Guarantees, users can be confident in their choices and the value they receive.

Unbiased Platform: As a broker, InsureMyTrip doesn't push its own products but instead offers an unbiased comparison of various providers.

As with any company, there are disadvantages to working with any company. In InsureMyTrips case:

No Direct Claims Filing: InsureMyTrip doesn't facilitate the claims filing process, which means users have to approach the insurance provider directly.

Limited Customer Service: While they do offer customer service, some users have reported delays or challenges in getting timely support.

No Proprietary Insurance Packages: Unlike some competitors, InsureMyTrip doesn't offer its travel insurance packages.

Overwhelming Options: For some users, the vast number of options can be overwhelming, making it challenging to decide on the best plan.

Varied User Experiences: As the platform connects users to various providers, the quality of service can vary depending on the chosen provider.

Insurdinary, with a robust network of partners, stands as a trusted resource for various insurance needs, including travel coverage. In addition to excelling in the travel insurance domain, we specialize in providing comprehensive insurance solutions across different sectors. Recognize the value of tailored coverage with Insurdinary for a secure and worry-free journey.

Safe travels!